Are you tired of paying for credit monitoring services that cost an arm and a leg? Credit Karma claims to offer a solution with its completely free credit scores and reports. But is this service really as good as it sounds, or is there a catch?

In this no-nonsense Credit Karma review, we’ll take a deep dive into the platform’s features, benefits, and drawbacks to help you decide if it’s the right fit for your needs. Our goal is to provide an unbiased, honest assessment based on real-world experience and in-depth research.

What Is Credit Karma?

At its core, Credit Karma is a personal finance platform that provides free credit scores, credit reports, and credit monitoring services to consumers. Founded in 2007, the company’s mission is to help people make financial progress by offering tools and insights to understand and improve their credit health.

Key features of Credit Karma include:

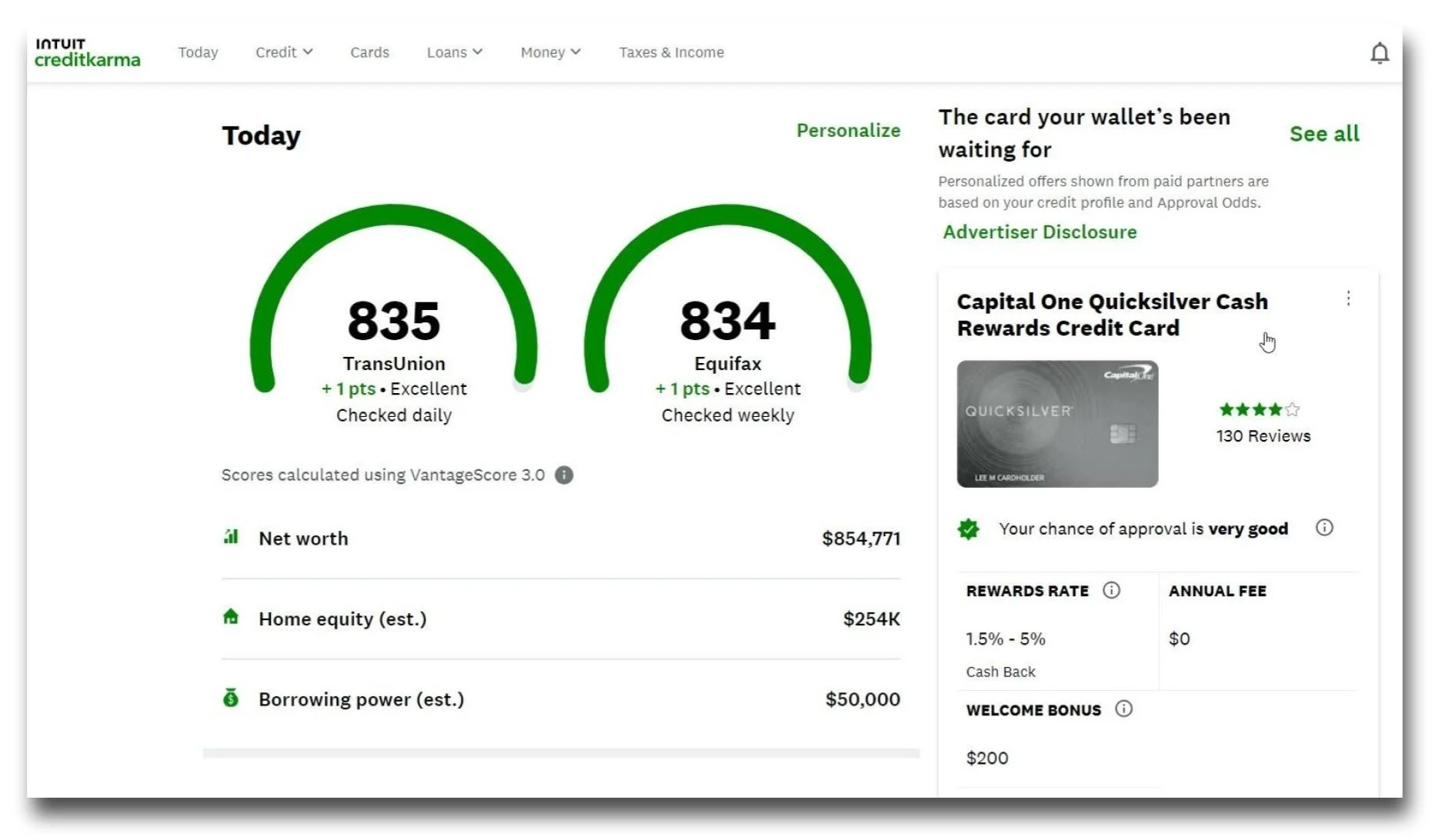

– Free credit scores from TransUnion and Equifax

– Weekly updates to your credit reports

– Credit monitoring and alerts for suspicious activity

– Personalized recommendations for credit cards and loans

– Financial calculators and educational resources

One of the most appealing aspects of Credit Karma is that it’s completely free to use. Instead of charging users, the company earns revenue by promoting targeted offers from its advertising partners based on your credit profile.

Real-World Experience

To truly evaluate Credit Karma, I signed up for an account and used the service for several months. The signup process was quick and painless, requiring only basic personal information and a soft credit check that doesn’t impact your scores.

Once inside the platform, I found the interface to be clean, intuitive, and easy to navigate. The dashboard prominently displays your TransUnion and Equifax credit scores, along with a breakdown of the key factors influencing them. As advertised, the scores seem to update on a weekly basis.

One feature I particularly appreciated was the **credit monitoring alerts**. Whenever a new hard inquiry or significant change appeared on my credit reports, I received a timely notification explaining what happened and how it might impact my scores.

The personalized product recommendations, however, were a bit hit-or-miss. While some suggestions were relevant to my credit profile, others seemed more focused on promoting Credit Karma’s partners than providing the best possible options.

Competitor Comparison

To put Credit Karma’s offering in context, let’s see how it stacks up against some of its main competitors:

Credit Sesame

Like Credit Karma, Credit Sesame provides free TransUnion credit scores and reports. However, it doesn’t include information from Equifax, which could be a drawback for users who want a more complete picture of their credit. On the plus side, Credit Sesame offers free identity theft protection that Credit Karma lacks.

NerdWallet

NerdWallet is another well-known name in the personal finance space that offers free TransUnion scores and reports. While its credit monitoring features are similar to Credit Karma’s, NerdWallet places a greater emphasis on educational content and calculators to help users make informed financial decisions.

Paid Alternatives

Of course, there are also many paid credit monitoring services on the market, such as IdentityForce and PrivacyGuard. These platforms typically offer more comprehensive features, like three-bureau credit monitoring, identity theft insurance, and 24/7 support. However, they often come with monthly or annual fees that can add up over time.

Overall, Credit Karma holds its own against the competition by providing a robust set of free tools for building credit awareness. While it may not be as comprehensive as some paid services, it offers excellent value for the price (or lack thereof).

Pros and Cons

To make your decision easier, let’s summarize the key advantages and disadvantages of using Credit Karma.

- ✓Truly free credit scores and reports with no hidden fees or trial periods

- ✓User-friendly interface that makes it easy to understand your credit

- ✓Actionable insights to help you improve your scores over time

- ✓Helpful credit monitoring alerts to catch potential issues early

- –No Experian credit data, which can be important for getting a complete picture of your credit

- –Hit-or-miss product recommendations that sometimes prioritize promotions over personalization

- –Lack of more premium features offered by some paid competitors, like three-bureau monitoring and identity theft insurance.

Frequently Asked Questions

How accurate are Credit Karma’s scores compared to FICO?

Credit Karma provides VantageScore 3.0 credit scores, which are similar to FICO scores but not identical. While VantageScore is a legitimate scoring model, it’s important to keep in mind that most lenders still use FICO scores when making credit decisions.

Will checking my scores on Credit Karma hurt my credit?

Not at all! Checking your own credit scores is considered a soft inquiry and has no impact on your credit. You can check as often as you like without any negative consequences.

Is Credit Karma selling my data to advertisers?

Credit Karma doesn’t sell your personal information to outside parties. However, it does use your credit profile to generate targeted advertising offers from its partners. If you’re not comfortable with this arrangement, you may want to opt for a paid credit monitoring service instead.

Final Verdict

After extensively testing Credit Karma for this review, I can confidently say that it lives up to its promise of providing valuable credit monitoring tools at no cost to consumers. The user-friendly interface, weekly updates, and helpful insights make it a solid choice for anyone looking to take control of their credit.

However, it’s important to understand the limitations of the service. The lack of Experian data and occasional less-than-personalized product recommendations are worth keeping in mind. Additionally, those who need more robust features like identity theft insurance may want to consider paid alternatives.

Overall, though, Credit Karma is an excellent starting point for anyone new to credit monitoring or looking to improve their financial health. With no fees and no strings attached, it’s an incredibly accessible way to stay on top of your credit situation and work towards your goals. While not perfect, it delivers exceptional value for the low price of $0.

The product is ok.

No a huge fan